INSURANCE

What is a Mortgage Used to Purchase? Everything You Need to Know

A mortgage is one of the most common financial tools people use to buy real estate. It’s essentially a loan, secured by the property you intend to purchase, what is a mortgage used to purchase that allows you to pay off the cost of a house or another type of real estate over time, usually 15 to 30 years. Most of us don’t have hundreds of thousands of dollars sitting around to buy a home outright, which is where mortgages come in—they make homeownership more accessible by spreading the cost over decades.

What Is a Mortgage?

Before diving into what a mortgage is used to purchase, let’s clarify what it is. A mortgage is a type of loan provided by a financial institution, such as a bank or credit union, that allows you to buy a property. The loan is secured by the property, meaning if you fail to make your payments, the lender can seize and sell the property to recoup their money.

Key elements of a mortgage include:

- Principal: The amount of money you’re borrowing.

- Interest: The cost of borrowing the money, usually expressed as a percentage of the loan.

- Term: The length of time over which you’ll pay back the loan, typically 15, 20, or 30 years.

- Monthly Payments: Payments made to the lender that cover both principal and interest.

But, what can you buy with a mortgage? Let’s take a closer look.

Purchasing a Primary Residence

The most common use of a mortgage is to buy a primary residence—this is the home you’ll live in. Whether you’re buying a single-family house, a condo, or a townhouse, a mortgage helps you finance the purchase without needing the entire cost upfront.

For most people, buying a home is the biggest financial decision they’ll ever make. Since homes can cost hundreds of thousands of dollars, most buyers rely on mortgages to cover the majority of the purchase price, making homeownership possible.

When you buy a home, you’ll typically need to make a down payment—a portion of the purchase price that you pay upfront, with the rest financed through the mortgage. The standard down payment is usually around 20%, though many buyers put down less, sometimes as little as 3% with certain types of loans.

Investment Properties

Mortgages aren’t limited to just buying your primary home—they’re also used to purchase investment properties. These could be properties that you plan to rent out to tenants, like a rental home or a multi-family building.

Getting a mortgage for an investment property is slightly different than getting one for a home you’ll live in. Lenders usually require a higher down payment (typically 20–25%) and charge higher interest rates because investment properties carry more risk. However, for many real estate investors, the potential rental income from the property can offset the cost of the mortgage, and over time, the value of the property may increase, providing long-term financial benefits.

Vacation or Second Homes

If you’re lucky enough to be in a financial position to buy a second home—perhaps a vacation home near the beach or a cabin in the mountains—you can also use a mortgage to finance this type of purchase.

Second homes differ from primary residences in that you won’t live in them full-time. Because of this, the terms of a mortgage for a second home may be different. Lenders often look at second-home buyers as higher-risk borrowers, so you might face stricter lending requirements, including a larger down payment and a higher interest rate.

4. Commercial Real Estate

Mortgages can also be used to buy commercial real estate—property used for business purposes. This includes office buildings, retail spaces, warehouses, and industrial properties. Commercial mortgages work similarly to residential mortgages, but they tend to have shorter terms (typically 5-20 years) and higher interest rates.

Lenders will look closely at the financial strength of the business purchasing the property, its revenue, and its ability to repay the loan. If you’re a business owner considering buying a building for your company, a commercial mortgage could be the key to expanding your operations.

Land for Future Development

Another lesser-known use of a mortgage is for purchasing land. Whether you plan to build a home, start a farm, or develop a commercial project, you can use a land mortgage to buy the property.

Land mortgages are somewhat riskier for lenders because vacant land doesn’t generate income and can be harder to sell if the borrower defaults. As a result, these loans typically have higher interest rates and require larger down payments. However, they can be a great option for people looking to buy land for a future construction project or investment.

Refinancing an Existing Mortgage

When you refinance, you’re essentially replacing your current mortgage with a new one—usually to take advantage of lower interest rates, change the loan term, or convert from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

Refinancing can save you money on interest payments or reduce your monthly mortgage payment, making it easier to manage your finances. Some homeowners also refinance to tap into the equity they’ve built up in their home, using the cash for home improvements, debt consolidation, or other large expenses.

Comparing Competitor Articles: Why This Guide Is Better

Our post goes beyond the basics by exploring multiple uses for mortgages, from primary residences to land purchases. Additionally, we keep the language simple and relatable, avoiding unnecessary jargon, and break down each section with clear, digestible subheadings. This makes it more accessible for readers who aren’t financial experts.

This blog also covers newer topics, such as mortgages for commercial properties and land development, which other posts often leave out. By addressing these, we provide a broader perspective on the many uses of mortgages, not just the standard home loan.

Conclusion

In summary, mortgages are incredibly versatile financial tools that can be used for a wide range of property purchases. Whether you’re buying your first home, expanding your real estate portfolio, or planning a new commercial venture, a mortgage can help you achieve your goals. However, it’s essential to understand the terms, conditions, and requirements of the mortgage that fits your specific needs.

Make sure to consult with financial professionals before taking out a mortgage, so you can get the best terms possible for your unique situation.

FAQs

Can I use a mortgage to buy a vacation home?

Yes, mortgages can be used to finance the purchase of a vacation or second home. However, these loans may come with higher interest rates and stricter requirements than loans for primary residences.

Do I need a large down payment for an investment property?

Yes, most lenders require a down payment of 20-25% for investment properties, which is higher than the down payment typically required for primary residences.

Can I use a mortgage to buy land?

Yes, there are special mortgages available for purchasing land, but they may have higher interest rates and require larger down payments due to the risk involved.

What does it mean to refinance a mortgage?

Refinancing involves replacing your current mortgage with a new one, typically to get better terms like a lower interest rate or a different loan term.

INSURANCE

Understanding Unit 102: A Comprehensive Guide

In various educational and professional contexts, “Unit 102” denotes a specific module or course component. Its content varies across disciplines, but it often introduces foundational concepts essential for advanced learning. This article delves into the significance of unit 102 across different fields, highlighting its objectives, typical content, and its role in building a solid knowledge base.

The Role of Unit 102 in Educational Curricula

Unit 102 serves as a building block in many educational programs, providing students with essential knowledge and skills. It often follows an introductory unit (Unit 101) and precedes more specialized modules. The content of unit 102 varies depending on the discipline but generally aims to deepen understanding and prepare students for more complex topics.

Common Themes in Unit 102 Across Disciplines

While the specifics of Unit 102 differ across fields, several common themes emerge:

- Fundamental Concepts: Unit 102 often covers core principles that are crucial for advanced study. For example, in a British Sign Language course, Unit 102 focuses on conversational skills, enabling learners to engage in basic social interactions.

- Practical Skills: Many Unit 102 modules emphasize hands-on skills. In electrical installation programs, Unit 102 addresses health, safety, and environmental considerations, ensuring that learners can work safely and responsibly.

- Professional Practices: Some Unit 102 units introduce industry standards and professional behaviors. In salon management courses, Unit 102 covers presenting a professional image, teaching students the importance of appearance and conduct in a professional setting.

Examples of Unit 102 in Various Fields

To illustrate the diversity of Unit 102, let’s explore its application in different disciplines:

- British Sign Language (BSL): In BSL courses, Unit 102, titled “Conversational British Sign Language,” focuses on developing both productive and receptive skills. Learners engage in simple exchanges, covering topics like describing people, using numbers, discussing interests, and talking about food and drink. The unit emphasizes correct hand shapes, facial expressions, and BSL structure to ensure effective communication.

- Electrical Installation: In the NVQ 2346-03 Level 3 Electrical Installation Qualification, Unit 102 is dedicated to “Health, Safety and Environmental Considerations.” This unit equips learners with the knowledge to apply health and safety legislation in the workplace, assess work environments for hazards, and implement safe working procedures. It covers topics such as risk assessments, safe use of tools and equipment, and environmental legislation compliance.

- Salon Management: For those pursuing a career in the beauty industry, Unit 102 often focuses on “Presenting a Professional Image in a Salon.” This unit teaches learners how to maintain a professional appearance, communicate effectively with clients, and adhere to salon policies. It covers aspects like personal hygiene, appropriate attire, and professional behavior to ensure a positive client experience.

The Importance of Unit 102 in Skill Development

Unit 102 plays a crucial role in bridging the gap between introductory knowledge and more advanced concepts. By focusing on fundamental skills and professional practices, it prepares learners for the challenges of their chosen field. Successfully completing unit 102 often serves as a prerequisite for more specialized units, underscoring its importance in the learning pathway.

Conclusion

Understanding the role and content of Unit 102 is essential for students and professionals across various disciplines. By providing foundational knowledge and skills, Unit 102 sets the stage for advanced learning and professional development. Whether it’s mastering conversational skills in a new language, adhering to safety standards in technical fields, or presenting a professional image in client-facing roles, Unit 102 equips learners with the tools they need to succeed.

FAQs

What is Unit 102?

Unit 102 is a foundational module in many educational and vocational programs, focusing on essential concepts and skills specific to a field of study.

What topics does Unit 102 cover?

The topics vary by discipline but often include core principles, practical skills, and professional practices, such as safety standards, communication skills, or professional image presentation.

Why is Unit 102 important?

It bridges the gap between introductory and advanced concepts, helping learners build a solid foundation for further study or professional development.

Can I take Unit 102 without completing Unit 101?

Typically, Unit 101 is a prerequisite as it introduces basic concepts needed to succeed in Unit 102.

How is Unit 102 assessed?

Assessment methods vary but may include practical demonstrations, written exams, or coursework designed to test both theoretical knowledge and applied skills.

INSURANCE

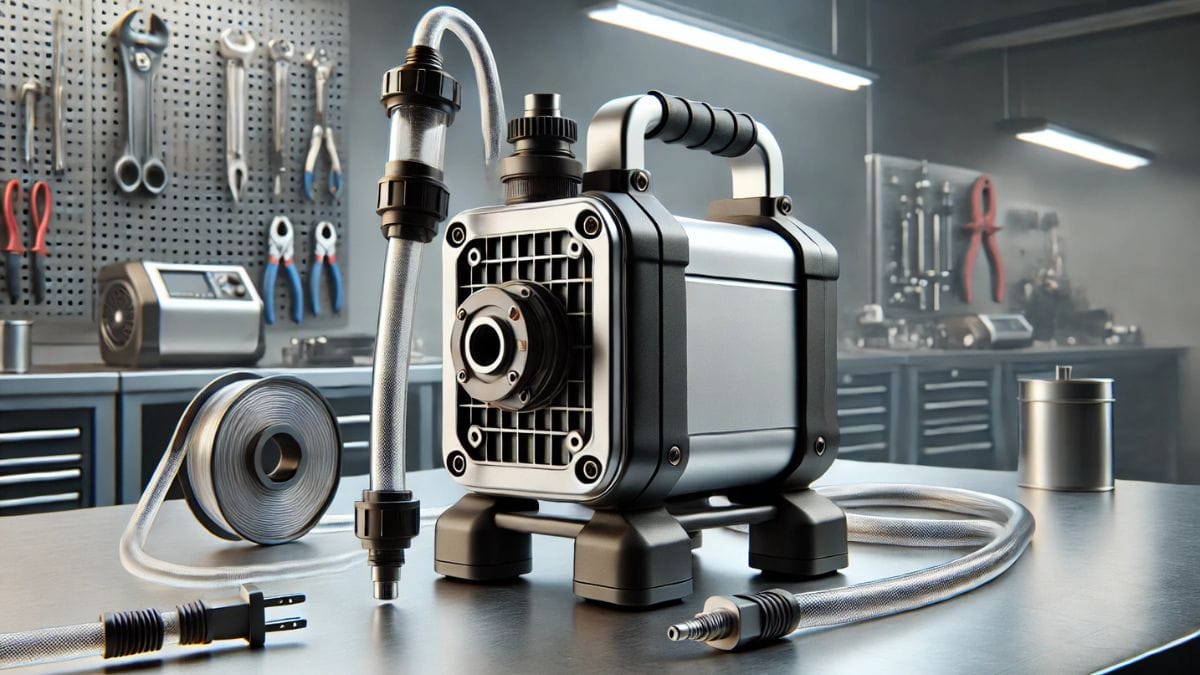

Understanding Oil Transfer Pumps: A Comprehensive Guide

Oil transfer pump are essential tools in various industries, facilitating the efficient movement of oil and other fluids from one container to another. Whether you’re in the automotive sector, industrial manufacturing, or agriculture, understanding the types, applications, and maintenance of these pumps is crucial. This guide delves into the intricacies of oil transfer pumps, offering insights to help you make informed decisions.

What is an Oil Transfer Pump?

An oil transfer pump is a device designed to move oil from one location to another. These pumps are vital in scenarios where manual transfer would be inefficient or impractical. They come in various designs and capacities, tailored to specific applications and fluid types.

Types of Oil Transfer Pumps

- Manual Pumps: Operated by hand, these are suitable for small-scale operations where precision and control are paramount. They are cost-effective and easy to use but may not be ideal for transferring large volumes.

- Electric Pumps: Powered by electricity, these pumps are efficient and capable of handling larger volumes. They are commonly used in industrial settings where speed and volume are critical.

- Pneumatic Pumps: Utilizing compressed air, pneumatic pumps are ideal in environments where electrical power sources are unavailable or pose a risk. They are often used in hazardous areas due to their safety features.

- Hydraulic Pumps: These pumps use hydraulic power to transfer oil, offering high pressure and flow rates. They are suitable for heavy-duty applications requiring robust performance.

Applications of Oil Transfer Pumps

- Automotive Industry: Used for transferring engine oils, lubricants, and other fluids during maintenance and manufacturing processes.

- Industrial Manufacturing: Essential for moving oils and lubricants in machinery, ensuring smooth operations and reducing downtime.

- Agriculture: Employed in transferring oils for machinery maintenance, ensuring equipment longevity and efficiency.

- Marine: Vital for transferring fuel oils and lubricants in ships and boats, maintaining operational readiness.

Key Features to Consider

When selecting an oil transfer pump, consider the following features:

- Flow Rate: Determines how quickly the pump can transfer oil. Higher flow rates are suitable for large volumes, while lower rates offer precision.

- Viscosity Compatibility: Ensure the pump can handle the viscosity of the oil you intend to transfer.

- Material Construction: Pumps should be made from materials compatible with the oil type to prevent corrosion and degradation.

- Power Source: Choose between manual, electric, pneumatic, or hydraulic based on your operational needs and available resources.

Maintenance and Safety Tips

- Regular Inspection: Periodically check for wear and tear, leaks, and other signs of damage.

- Proper Cleaning: After use, clean the pump to prevent contamination and ensure longevity.

- Follow Manufacturer Guidelines: Adhere to the manufacturer’s instructions for operation and maintenance to ensure safety and efficiency.

- Use Appropriate Personal Protective Equipment (PPE): Always wear suitable PPE to protect against potential hazards during operation.

Conclusion

Oil transfer pumps are indispensable tools across various industries, offering efficient and safe fluid transfer solutions. By understanding the different types, applications, and maintenance practices, you can select the right pump for your needs and ensure its optimal performance over time.

FAQs

What types of oil transfer pumps are available?

There are manual, electric, pneumatic, and hydraulic oil transfer pumps. Each type is suited to specific applications and operational needs.

How do I choose the right oil transfer pump?

Consider factors such as the type of oil, flow rate, viscosity, pump material, and available power sources when selecting a pump.

Are oil transfer pumps safe to use?

Yes, when used according to manufacturer guidelines. Always inspect the pump before use and wear appropriate personal protective equipment (PPE).

How do I maintain an oil transfer pump?

Regularly inspect the pump for wear, clean it after use, and follow the manufacturer’s maintenance recommendations to ensure longevity and efficiency.

INSURANCE

Unlocking Your Future: How to Earn a Free Master’s Degree Online

CRYPTO3 months ago

CRYPTO3 months agoCrypto-Engine.Pro Blog: Your Go-To Source for Crypto Trading Insights

GENERAL3 weeks ago

GENERAL3 weeks agoUnderstanding TNA Board: A Comprehensive Guide for Beginners

GENERAL4 months ago

GENERAL4 months agoEverything You Need to Know About NSFW411: The Ultimate Guide

ENTERTAINMENT4 months ago

ENTERTAINMENT4 months agoExploring Mywape: Your Guide to Quality Vaping

FOOD5 months ago

FOOD5 months agoExploring the Benefits of süberlig: A Comprehensive Guide

BLOG4 months ago

BLOG4 months agoDiscover the Secrets Behind the /vital-mag.net blog: A Closer Look at the Popular Blog

FOOD5 months ago

FOOD5 months agoUnveiling the Beauty of Tamisie: A Guide to this Exquisite Fabric

ENTERTAINMENT4 months ago

ENTERTAINMENT4 months agoNavigating Erome: Tips and Tricks for a Safer Experience on Adult Platforms