INSURANCE

The Ins and Outs of OpenHousePerth.net Insurance: What You Need to Know

Welcome to the world of OpenHousePerth.net Insurance, where peace of mind meets property protection! Whether you’re a homeowner, landlord, or tenant, having the right insurance coverage for your property is essential. In this blog post, we’ll delve into the ins and outs of OpenHousePerth.net Insurance so you can make an informed decision about safeguarding your most valuable asset. From assessing your insurance needs to exploring different coverage options and comparing providers, we’ve got you covered every step of the way. Let’s dive in and unravel everything you need to know about OpenHousePerth.net Insurance!

Recent Posts

Stay up to date with the latest insights and news on Openhouseperth.net Insurance by checking out our recent posts. Learn about insurance trends, tips, and more!

Recent Comments

Engage with our community by reading and responding to recent comments on OpenHousePerth.net Insurance. Join the conversation, share insights, and learn from others’ experiences.

Archives

When exploring OpenHousePerth.net Insurance, consider browsing through the archives to find valuable insights and information on past insurance plans and offerings. Stay informed about previous policies for a comprehensive understanding of their services.

Categories

When it comes to Openhouseperth.net insurance, understanding the different categories is crucial. From building insurance to contents coverage, each type serves a specific purpose in safeguarding your property and belongings.

Introduction to Openhouseperth.net Insurance

When it comes to safeguarding your property, Openhouseperth.net Insurance provides comprehensive coverage options. Learn about their insurance plans tailored to protect your home and belongings.

Assessing Your Property’s Insurance Needs

When considering insurance for your property, evaluate the value of your home and possessions to determine the coverage needed. Assess potential risks and vulnerabilities to ensure you choose the right insurance plan.

Types of Insurance Plans Available

When it comes to OpenHousePerth.net Insurance, there are various types of insurance plans available for your property. These include building insurance, contents insurance, and combined building and contents insurance. Each plan caters to different needs and coverage options.

Building Insurance

When it comes to protecting your property, building insurance is essential. It covers the structure of your home against damages from events like fire or natural disasters. Be sure to assess your property’s needs carefully.

Contents Insurance

Contents Insurance covers your personal belongings inside your property. It protects items like furniture, electronics, and clothing from theft or damage. Make sure to assess the value of your possessions when considering this type of insurance.

Combined Building and Contents Insurance

When it comes to protecting your property, consider a Combined Building and Contents Insurance plan. This comprehensive coverage safeguards both the structure of your home and its contents against various risks in one convenient policy.

Additional Coverage Options

When it comes to Openhouseperth.net Insurance, you can explore additional coverage options beyond the standard building and contents insurance. This includes protection for accidental damage, landlord insurance, and legal liability coverage.

Comparing Insurance Providers

When looking for insurance, compare providers based on reputation, customer service, and claim process efficiency. Consider different options to find the best fit for your property’s needs.

Reputation and Reliability

When choosing an insurance provider, consider their reputation and reliability. Look for companies with a strong track record of delivering on their promises and providing efficient services to their clients.

Customer Service and Support

When choosing insurance, consider the quality of customer service and support. Accessible help can make a significant difference during stressful times. Research providers’ reputation for assistance before making a decision.

Claim Process Efficiency

When it comes to OpenHousePerth.net Insurance, the claim process efficiency is crucial. Ensure quick and hassle-free claims processing by understanding the steps involved and providing all necessary documentation promptly.

Tools and Resources for Comparing Insurance Providers

When looking for insurance providers, utilize online comparison tools to easily compare coverage options and prices. Resources like websites and apps can help you make an informed decision based on your property’s specific needs.

How Can I Select the Right plan for my property?

When selecting the right insurance plan for your property, consider factors like coverage limits, deductibles, and additional benefits. Assess your property’s needs and compare different plans to find the best fit.

What You Need to Know about Openhouseperth.net Insurance

When considering Openhouseperth.net Insurance, remember to assess your property’s insurance needs, explore the types of plans available, and compare providers for reputation, reliability, and customer service.

Assessing Benefits and Drawbacks of Openhouseperth.net Insurance

When assessing Openhouseperth.net Insurance, consider benefits like comprehensive coverage and competitive premiums. Drawbacks may include limited add-on options and potential policy restrictions.

Insights from the Community

Hearing from the community can provide valuable insights into Openhouseperth.net insurance. Real-life experiences and feedback can help you make informed decisions about your property coverage needs.

Others Also Viewed

Discover what others have viewed to get more insights into Openhouseperth.net Insurance. Stay informed and make well-informed decisions based on popular choices within the community.

Explore Topics

Explore a variety of topics related to Openhouseperth.net insurance. From building coverage to claim processes, delve into essential information to make informed decisions about protecting your property.

Sign In to View More Content

To access additional insightful articles and resources on Openhouseperth.net insurance, simply sign in to view more content. Stay informed and make well-informed decisions for your property’s insurance needs.

Welcome Back

Welcome back to OpenHousePerth.net Insurance! We’re thrilled to have you here as we delve into the ins and outs of property insurance. Stay tuned for valuable insights and tips on selecting the right insurance plan for your property.

More Articles by This Author

Explore more insightful articles by this author to delve deeper into the world of insurance and property management. Stay informed and expand your knowledge on related topics.

Sign In to View More Content

For exclusive access to more articles by this author, sign in and unlock a wealth of information on Openhouseperth.net insurance. Dive deeper into insights and tips for selecting the right insurance plan for your property.

Welcome Back

Welcome back to OpenHousePerth.net Insurance blog! We are excited to have you here as we delve into the ins and outs of property insurance. Stay tuned for valuable insights and tips on selecting the right coverage for your property.

More Articles by This Author

Sign in to view more content by this author. Explore a variety of informative articles on home insurance, property protection, and insurance provider comparisons for valuable insights and tips.

Sign In to View More Content

To access exclusive content and valuable insights on Openhouseperth.net insurance, simply sign in. Unlock a wealth of information to help you make informed decisions about your property insurance needs.

Welcome Back

Welcome back to OpenHousePerth.net Insurance! We’re glad to have you here. Let’s dive into the world of property insurance together and explore all that you need to know for protecting your valuable assets.

More Articles by This Author

Explore more insightful articles written by this author for valuable information and expert tips on various topics. Stay informed and engaged with our diverse range of content.

Discovering The Hidden Techniques: Home Insurance Claim Adjuster Secret Tactics

Unveil the strategies used by home insurance claim adjusters to navigate claims efficiently. Understanding these tactics can help policyholders advocate for fair settlements and avoid potential pitfalls during the claims process.

Leave a Reply Cancel Reply

When engaging with our blog, feel free to share your thoughts in the comments section. Your input is valuable for building a community of insights and experiences related to Openhouseperth.net insurance.

Conclusion

After exploring the ins and outs of Openhouseperth.net Insurances, it’s evident that understanding your property insurance needs is crucial. Make an informed decision based on thorough assessment for comprehensive coverage.

FAQs

Is OpenHousePerth.net insurances only for residential properties?

No, OpenHousePerth.net offers insurance for both residential and commercial properties.

How can I file a claim with OpenHousePerth.net Insurance?

You can easily file a claim online through their website or by contacting their customer service hotline.

Can I customize my insurance plan with additional coverage options?

Yes, OpenHousePerth.net provides various add-on options to tailor your insurance plan according to your specific needs.

Are there any discounts available for multiple policies or loyal customers?

Yes, OpenHousePerth.net offers discounts for bundling multiple policies together and rewards loyal customers with special promotions.

What sets Openhouseperth.net Insurances apart from other providers?

With its comprehensive coverage options, reliable customer service, and competitive rates, Openhouseperth.net Insurances stands out as a top choice in the market.

INSURANCE

Understanding Unit 102: A Comprehensive Guide

In various educational and professional contexts, “Unit 102” denotes a specific module or course component. Its content varies across disciplines, but it often introduces foundational concepts essential for advanced learning. This article delves into the significance of unit 102 across different fields, highlighting its objectives, typical content, and its role in building a solid knowledge base.

The Role of Unit 102 in Educational Curricula

Unit 102 serves as a building block in many educational programs, providing students with essential knowledge and skills. It often follows an introductory unit (Unit 101) and precedes more specialized modules. The content of unit 102 varies depending on the discipline but generally aims to deepen understanding and prepare students for more complex topics.

Common Themes in Unit 102 Across Disciplines

While the specifics of Unit 102 differ across fields, several common themes emerge:

- Fundamental Concepts: Unit 102 often covers core principles that are crucial for advanced study. For example, in a British Sign Language course, Unit 102 focuses on conversational skills, enabling learners to engage in basic social interactions.

- Practical Skills: Many Unit 102 modules emphasize hands-on skills. In electrical installation programs, Unit 102 addresses health, safety, and environmental considerations, ensuring that learners can work safely and responsibly.

- Professional Practices: Some Unit 102 units introduce industry standards and professional behaviors. In salon management courses, Unit 102 covers presenting a professional image, teaching students the importance of appearance and conduct in a professional setting.

Examples of Unit 102 in Various Fields

To illustrate the diversity of Unit 102, let’s explore its application in different disciplines:

- British Sign Language (BSL): In BSL courses, Unit 102, titled “Conversational British Sign Language,” focuses on developing both productive and receptive skills. Learners engage in simple exchanges, covering topics like describing people, using numbers, discussing interests, and talking about food and drink. The unit emphasizes correct hand shapes, facial expressions, and BSL structure to ensure effective communication.

- Electrical Installation: In the NVQ 2346-03 Level 3 Electrical Installation Qualification, Unit 102 is dedicated to “Health, Safety and Environmental Considerations.” This unit equips learners with the knowledge to apply health and safety legislation in the workplace, assess work environments for hazards, and implement safe working procedures. It covers topics such as risk assessments, safe use of tools and equipment, and environmental legislation compliance.

- Salon Management: For those pursuing a career in the beauty industry, Unit 102 often focuses on “Presenting a Professional Image in a Salon.” This unit teaches learners how to maintain a professional appearance, communicate effectively with clients, and adhere to salon policies. It covers aspects like personal hygiene, appropriate attire, and professional behavior to ensure a positive client experience.

The Importance of Unit 102 in Skill Development

Unit 102 plays a crucial role in bridging the gap between introductory knowledge and more advanced concepts. By focusing on fundamental skills and professional practices, it prepares learners for the challenges of their chosen field. Successfully completing unit 102 often serves as a prerequisite for more specialized units, underscoring its importance in the learning pathway.

Conclusion

Understanding the role and content of Unit 102 is essential for students and professionals across various disciplines. By providing foundational knowledge and skills, Unit 102 sets the stage for advanced learning and professional development. Whether it’s mastering conversational skills in a new language, adhering to safety standards in technical fields, or presenting a professional image in client-facing roles, Unit 102 equips learners with the tools they need to succeed.

FAQs

What is Unit 102?

Unit 102 is a foundational module in many educational and vocational programs, focusing on essential concepts and skills specific to a field of study.

What topics does Unit 102 cover?

The topics vary by discipline but often include core principles, practical skills, and professional practices, such as safety standards, communication skills, or professional image presentation.

Why is Unit 102 important?

It bridges the gap between introductory and advanced concepts, helping learners build a solid foundation for further study or professional development.

Can I take Unit 102 without completing Unit 101?

Typically, Unit 101 is a prerequisite as it introduces basic concepts needed to succeed in Unit 102.

How is Unit 102 assessed?

Assessment methods vary but may include practical demonstrations, written exams, or coursework designed to test both theoretical knowledge and applied skills.

INSURANCE

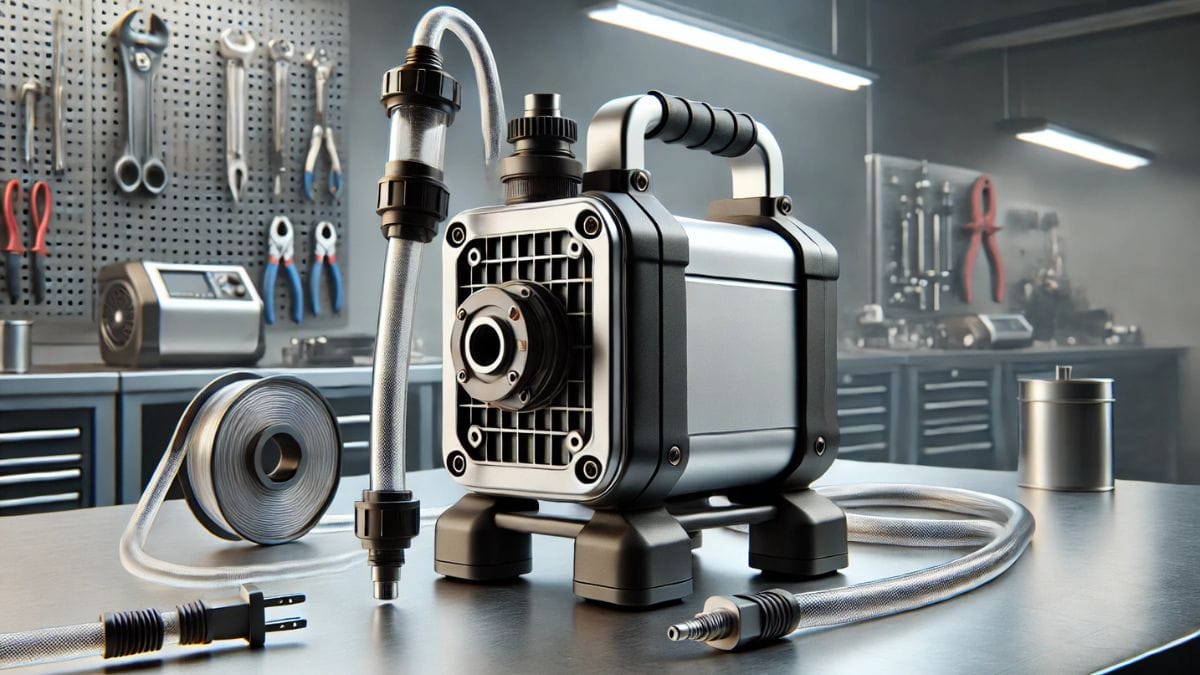

Understanding Oil Transfer Pumps: A Comprehensive Guide

Oil transfer pump are essential tools in various industries, facilitating the efficient movement of oil and other fluids from one container to another. Whether you’re in the automotive sector, industrial manufacturing, or agriculture, understanding the types, applications, and maintenance of these pumps is crucial. This guide delves into the intricacies of oil transfer pumps, offering insights to help you make informed decisions.

What is an Oil Transfer Pump?

An oil transfer pump is a device designed to move oil from one location to another. These pumps are vital in scenarios where manual transfer would be inefficient or impractical. They come in various designs and capacities, tailored to specific applications and fluid types.

Types of Oil Transfer Pumps

- Manual Pumps: Operated by hand, these are suitable for small-scale operations where precision and control are paramount. They are cost-effective and easy to use but may not be ideal for transferring large volumes.

- Electric Pumps: Powered by electricity, these pumps are efficient and capable of handling larger volumes. They are commonly used in industrial settings where speed and volume are critical.

- Pneumatic Pumps: Utilizing compressed air, pneumatic pumps are ideal in environments where electrical power sources are unavailable or pose a risk. They are often used in hazardous areas due to their safety features.

- Hydraulic Pumps: These pumps use hydraulic power to transfer oil, offering high pressure and flow rates. They are suitable for heavy-duty applications requiring robust performance.

Applications of Oil Transfer Pumps

- Automotive Industry: Used for transferring engine oils, lubricants, and other fluids during maintenance and manufacturing processes.

- Industrial Manufacturing: Essential for moving oils and lubricants in machinery, ensuring smooth operations and reducing downtime.

- Agriculture: Employed in transferring oils for machinery maintenance, ensuring equipment longevity and efficiency.

- Marine: Vital for transferring fuel oils and lubricants in ships and boats, maintaining operational readiness.

Key Features to Consider

When selecting an oil transfer pump, consider the following features:

- Flow Rate: Determines how quickly the pump can transfer oil. Higher flow rates are suitable for large volumes, while lower rates offer precision.

- Viscosity Compatibility: Ensure the pump can handle the viscosity of the oil you intend to transfer.

- Material Construction: Pumps should be made from materials compatible with the oil type to prevent corrosion and degradation.

- Power Source: Choose between manual, electric, pneumatic, or hydraulic based on your operational needs and available resources.

Maintenance and Safety Tips

- Regular Inspection: Periodically check for wear and tear, leaks, and other signs of damage.

- Proper Cleaning: After use, clean the pump to prevent contamination and ensure longevity.

- Follow Manufacturer Guidelines: Adhere to the manufacturer’s instructions for operation and maintenance to ensure safety and efficiency.

- Use Appropriate Personal Protective Equipment (PPE): Always wear suitable PPE to protect against potential hazards during operation.

Conclusion

Oil transfer pumps are indispensable tools across various industries, offering efficient and safe fluid transfer solutions. By understanding the different types, applications, and maintenance practices, you can select the right pump for your needs and ensure its optimal performance over time.

FAQs

What types of oil transfer pumps are available?

There are manual, electric, pneumatic, and hydraulic oil transfer pumps. Each type is suited to specific applications and operational needs.

How do I choose the right oil transfer pump?

Consider factors such as the type of oil, flow rate, viscosity, pump material, and available power sources when selecting a pump.

Are oil transfer pumps safe to use?

Yes, when used according to manufacturer guidelines. Always inspect the pump before use and wear appropriate personal protective equipment (PPE).

How do I maintain an oil transfer pump?

Regularly inspect the pump for wear, clean it after use, and follow the manufacturer’s maintenance recommendations to ensure longevity and efficiency.

INSURANCE

Unlocking Your Future: How to Earn a Free Master’s Degree Online

CRYPTO3 months ago

CRYPTO3 months agoCrypto-Engine.Pro Blog: Your Go-To Source for Crypto Trading Insights

GENERAL3 weeks ago

GENERAL3 weeks agoUnderstanding TNA Board: A Comprehensive Guide for Beginners

GENERAL4 months ago

GENERAL4 months agoEverything You Need to Know About NSFW411: The Ultimate Guide

ENTERTAINMENT4 months ago

ENTERTAINMENT4 months agoExploring Mywape: Your Guide to Quality Vaping

FOOD5 months ago

FOOD5 months agoExploring the Benefits of süberlig: A Comprehensive Guide

BLOG4 months ago

BLOG4 months agoDiscover the Secrets Behind the /vital-mag.net blog: A Closer Look at the Popular Blog

FOOD5 months ago

FOOD5 months agoUnveiling the Beauty of Tamisie: A Guide to this Exquisite Fabric

ENTERTAINMENT4 months ago

ENTERTAINMENT4 months agoNavigating Erome: Tips and Tricks for a Safer Experience on Adult Platforms